According to MarketsandMarkets, the CDN market is “expected to grow from $3.71B in 2014 to $12.16B by 2019” at an annual compound growth rate of 26.8%. If that’s the case, than Akamai represents 53% of the market in 2014, based on revenues of $2B. Let’s do a quick sanity check on the $3.71B estimate.

- Akamai: $2B

- Level 3 / CloudFront / EdgeCast / Limelight: $800M to $1B

- CDNetworks, ChinaCache, ChinaNetCenter: $300M to $400M

- Remaining 20-30 CDNs: $250M to $400M

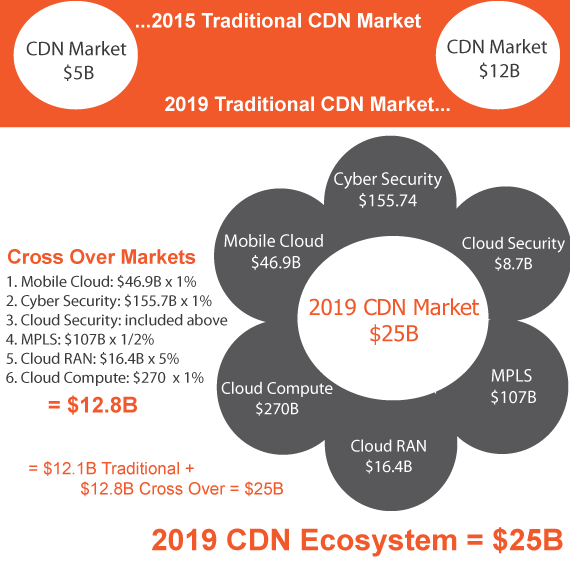

Based on the figures above, MarketsandMarkets is in the range for 2014. However, the estimate for 2019 is likely to be off by 50% or more. The reason is simple. Today, there is the traditional CDN market, which is comprised of traditional CDNs: pure-plays, transparent caching, telco CDNs, cloud providers with CDNs, start-ups, and so on. In 2019, there will be “no traditional CDN market”, but a market where the hybrid CDN thrives, providing non-traditional CDN services. The hybrid CDN business model started in 2014, and will explode in 2015. The hybrid CDNs are crossing over into other industries such as security, MPLS, compute, content exchange and wireless.

CDNs Invade Other Industries

Today’s CDN market is small, but in 2019 the CDN market is likely to be much larger than many predictions, especially as scavenger hungry CDNs invade other tech sectors looking for new revenue streams. Security is the largest and most obvious target market for CDNs, since the importance of next generation security is moving from behind-the-firewall to the edge, hence edge security. The MPLS market is another big one, as up-and-coming WAN as-a-service providers expand their offering targeting MPLS installations running ADC appliances. Cloud RAN is yet another market that is ripe for CDN invasion, as mobile devices and IoT explode in the next few years. What is the estimated market in 2019? That is an extremely difficult question to answer, since new business models are emerging and maturing as we speak, but what the heck, we’ll give it try.