Earlier in the year, we found out that Apple was in conversations with many of the leading networks about creating a skinny TV bundle for it customers. In doing so, one camp believes it will have dramatic repercussions on the OTT landscape. The other camp believes nothing special will happen, especially when the service is being priced at $30 to $40 a month, which is expensive. For now, Apple’s streaming service plans have been shelved, according CBS head honcho Les Moonves. And the strange thing, Akamai’s stock dipped on the news.

Apple is not going to disrupt the OTT market. Netflix is not going to disrupt the OTT market like it once did. No one is going to disrupt the OTT market in any way. Why?

- Because the OTT market is extremely crowded with many large, entrenched players. All that really happens in this space are movie and TV titles shifting from one media platform to another, and my guess is Akamai delivers titles for all of the major media companies.

- There are only so many titles to go around, and anyone can pay more money to get exclusives on the titles, locking out others in the process, so even Apple can be locked from some good titles.

- Global movie and TV programming licensing is a complex beast. We doubt Apple is going to license the exclusive rights for titles in all countries, thus, its’ ability to leverage its massive consumer base to sell streaming service is null and void.

- The last thing the Les Moonves of the world want to do is give Apple an inch, because if they do, Apple will go the mile, which is akin to Les shooting himself in the foot, and transferring some of that hard earned wealth from his company to Apple.

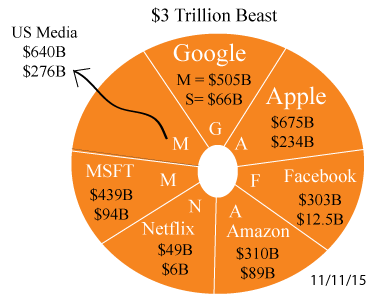

There is a war happening in the media business, and its Apple vs the US Media Tribe, as show below. Why is the Media Tribe worried? Because as of November 11, 2015, Apple’s market cap was larger than nine of the largest US media companies combined.

GAFAN-M vs US Media Tribe

US Media Tribe

| Companies | Global Rank | 2014 Sales in Billions | 2015 Mkt Cap in $B | |

| 1 | Comcast | 57 | 69 | 151 |

| 2 | Walt Disney | 100 | 49 | 195 |

| 3 | 21st Century Fox | 152 | 32 | 59 |

| 4 | Time Warner | 156 | 27 | 55 |

| 5 | Time Warner Cable | 252 | 23 | 53 |

| 6 | Directv | 300 | 33 | 47 |

| 7 | CBS | 367 | 14 | 30 |

| 8 | Viacom | 380 | 14 | 20 |

| 9 | Dish | 520 | 15 | 30 |

| source | ->yahoo finance | Totals | $276B | $640B |

Date of figures: 11/8/15