Oracle stunned Wall Street on Tuesday when it announced that OCI (cloud) revenue will jump from $20 billion to $144 billion in four years. That’s only the tip of the iceberg.

Public AI infrastructure companies such as CoreWeave, Nebius, and Iren are trading near their highs. Private AI Infrastructure companies like Crusoe and Lambda Labs are raising billions to build AI factories. Meanwhile, startup Neoclouds offering GPUaaS are raising hundreds of millions to purchase Nvidia GPU-based servers, lease data center space, build power and cooling systems, deploy networking gear, and hire skilled talent.

Investment in the industry has been nonstop, yet revenues haven’t kept up (outside of OpenAI). As a result, some are questioning the logic of continued investments, speculating we might be in an AI bubble since revenues are not correlating with the volume of capital pouring in. The troubled launch of ChatGPT 5 adds more fuel to the fire, with its promise of AGI and superintelligence looking greatly exaggerated.

One question many are asking is how long the bull market for AI infrastructure will last, especially since the economy and labor market are on shaky ground. With so much noise and so many moving pieces, it’s difficult to pinpoint what comes next. However, we’ll look at a few economic indicators and come to a logical conclusion.

Before diving into the competitive landscape of the market, it’s useful to break the ecosystem down into its components, what we’ll call segments. Fortunately, we’ve been doing market segmentation for more than a decade in the CDN industry, so we can bring that know-how into the equation. After all, AI infrastructure shares many similarities with the CDN industry.

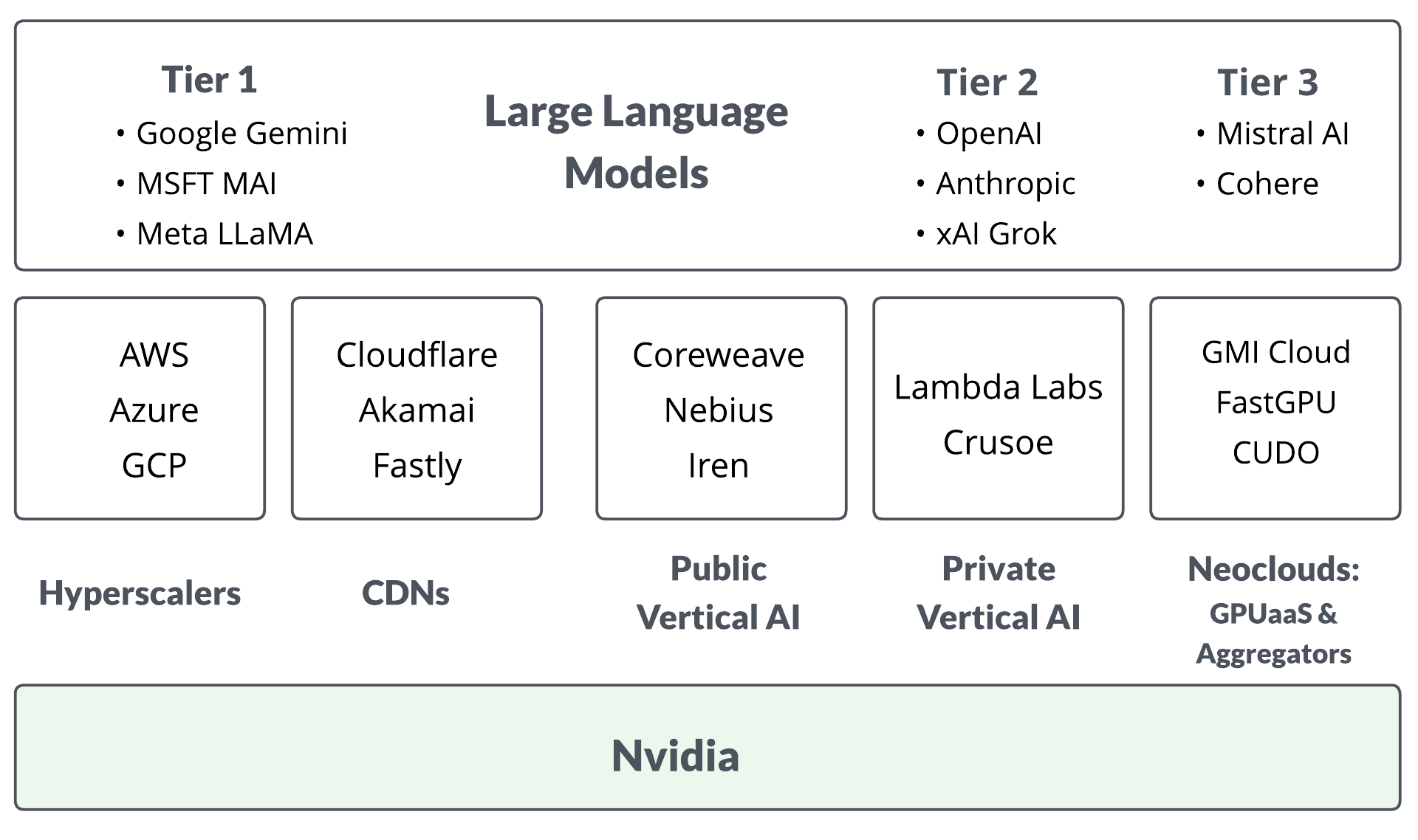

The diagram below illustrates the different segments in the AI infrastructure ecosystem. We’ll draw conclusions from this framework.

Breaking Down the Segments

The diagram divides the industry into segments, with each group of vendors playing an important role in the AI infrastructure ecosystem. Some segments are more resilient than others if the economy contracts. Starting from the strongest down to the weakest, here are the highlights:

- Nvidia – The undisputed global leader in GPUs.

- AWS, Azure, and GCP – Trillion-dollar companies with ~$100B each in cash and short-term investments on the balance sheet. In other words, they’re printing money.

- Cloudflare, Akamai, and Fastly – Public CDNs and leaders in their industry, each playing a role in the AI movement.

- CoreWeave, Nebius, and Iren – Not traditional Neoclouds, but vertically integrated AI infrastructure providers. They’re building AI factories on behalf of clients while also offering GPUaaS. Think of them as AI-focused versions of Equinix.

- Lambda Labs and Crusoe – Neoclouds evolving into CoreWeave-style companies, increasingly building AI factories for larger enterprises.

- Neoclouds (general segment) – Hundreds of smaller providers offering GPUaaS. They purchase GPUs and networking hardware, lease data center space, and rent GPUs by the hour, month, or year.

Nvidia: The Standard Oil of AI

Nvidia sits at the top of the AI ecosystem, eclipsing even the public cloud giants. The only real historical comparison in U.S. industry is Standard Oil, which once controlled 90% of the oil refining business. By one publication’s estimate, Nvidia controls 94% of the GPU market. Whether or not that figure is exact, the analogy holds: Nvidia GPUs are the oil of the AI industry.

If the economy were to contract, Nvidia’s position would remain secure. As the sole provider of the most critical hardware, demand for its GPUs would continue globally, ensuring its dominance.

The Cloud Giants and Beyond

Next in terms of resilience are the cloud giants. With enormous cash reserves, AWS, Azure, and GCP are well-positioned to weather an economic downturn. They could even use the opportunity to buy distressed assets at bargain prices.

The public CDNs come next. Cloudflare, Akamai, and Fastly are a resilient bunch, perhaps even more than the Public Vertical AI players. Over the past fifteen years, they’ve survived intense competition, industry turmoil, and consolidation in the CDN space. Their ability to adapt and thrive in difficult markets gives them a solid foundation in the AI era. From there, the rest of the market players line up across the spectrum—some positioned to endure, others more exposed as the cycle turns.

State of the US Economy

We’ve already covered which AI infrastructure segments are most at risk if the economy contracts. The bigger question now is: what’s the state of the economy today, and where is it heading over the next year? Is it slowing, and if so, how much? For us, the central issue isn’t whether we’re in an AI bubble; we don’t believe we are, but whether an economic downturn could pierce the AI veil and shake up the competitive landscape, forcing weaker players out of the market.

Consumer spending drives roughly 70% of U.S. GDP, supporting not only our economy but also many others around the world. If consumer spending slows, demand for goods and services falls, and technology spending inevitably takes a hit. The labor market plays a major role here: when fewer people are working, fewer people are buying. Recently, the Bureau of Labor Statistics announced a revision showing 911,000 fewer jobs than previously reported—the largest downward adjustment in U.S. history.

Job openings have also tightened. According to Federal Reserve data, openings peaked at 12.1M in March 2022 but dropped to 7.2M by July 2025—a decline of nearly 5M. Add to that anecdotal evidence from sites like layoff.fyi, Blind, and social media, where thousands of job loss posts appear weekly, and it’s clear the labor market is under pressure.

Real estate tells a similar story. Multiple analysts warn of a correction, pointing to elevated housing inventory, stress in the FHA loan market, and declining affordability for younger buyers. Gen Z and Millennials are largely priced out, even if rates were to fall. Baby Boomers, the wealthiest generation in U.S. history, are still the main buyers and sellers, but demographic trends are shifting. With 7,000 Boomers passing away each day (a figure expected to double in the coming years), housing supply dynamics will continue to change.

The takeaway: if both the labor and real estate markets weaken further (maybe crash), some segments of AI infrastructure, especially startups with minimal revenues, could face significant challenges. Larger, well-capitalized players like NVIDIA and the hyperscalers are far more likely to withstand turbulence. For smaller firms, the upcoming quarters may be difficult. That said, we are not financial analysts, and these observations should be taken as informed commentary rather than forecasts.

While the road ahead may bring headwinds, downturns also create opportunities. For NVIDIA, AWS, Cloudflare, and Akamai, the future looks stable given their scale and balance sheets. For everyone else in the ecosystem, now is the time to prepare—tighten operations, conserve cash, and focus on sustainable growth. Those who adapt quickly will be best positioned not only to weather the storm but also to thrive when the cycle turns upward again.