The launch of ChatGPT in late 2022 marked a turning point for the compute industry. Within months, AI vaulted to the top of the technology landscape, pulling entire markets along with it—applications, large language models, copilots, and more.

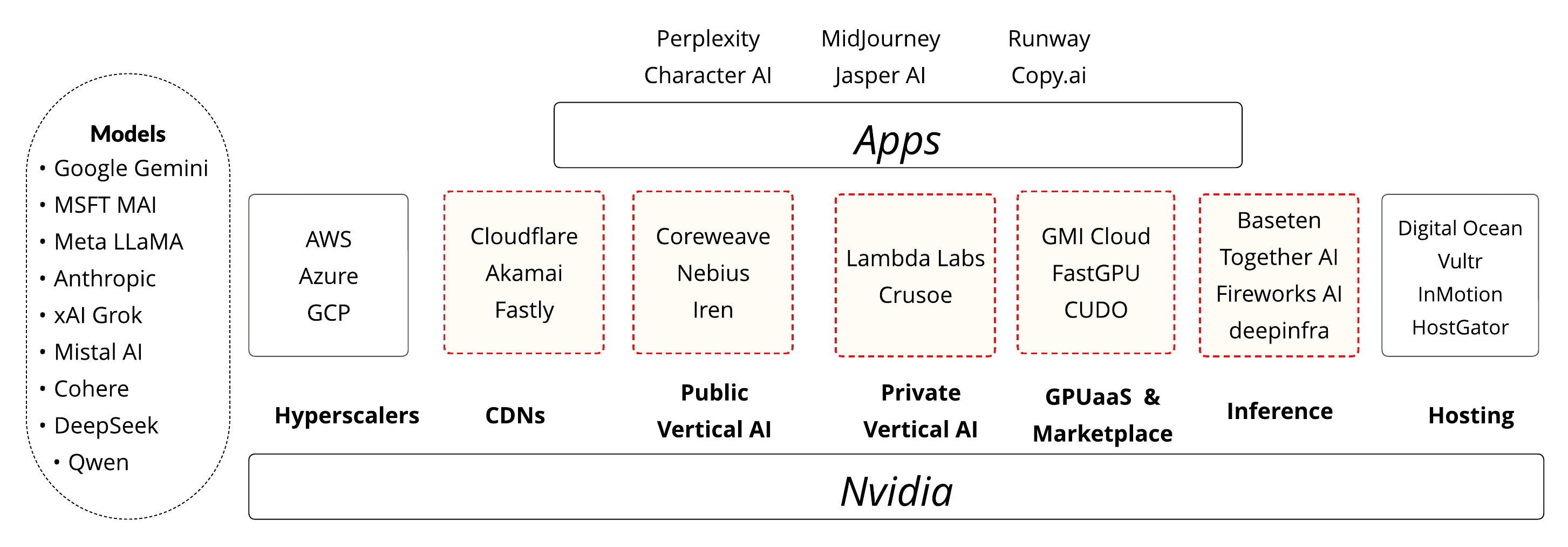

Among the most critical, yet least clearly defined, is the AI infrastructure ecosystem. Early on, the term Neoclouds emerged to describe GPU-as-a-Service (GPUaaS) providers such as Nebius and Lambda Labs. But as the industry has expanded, new business models have surfaced and existing ones have evolved. The Neocloud label no longer captures the full spectrum of players shaping this rapidly changing market.

To address this, we’ve developed a segmentation model that captures the major segments driving the industry forward. Each segment is represented by groups of competitors that are similar in approach, though not identical. These include the hyperscalers, CDNs, GPUaaS providers, and several others.

AI Infrastructure Ecosystem

Business Model Pivots

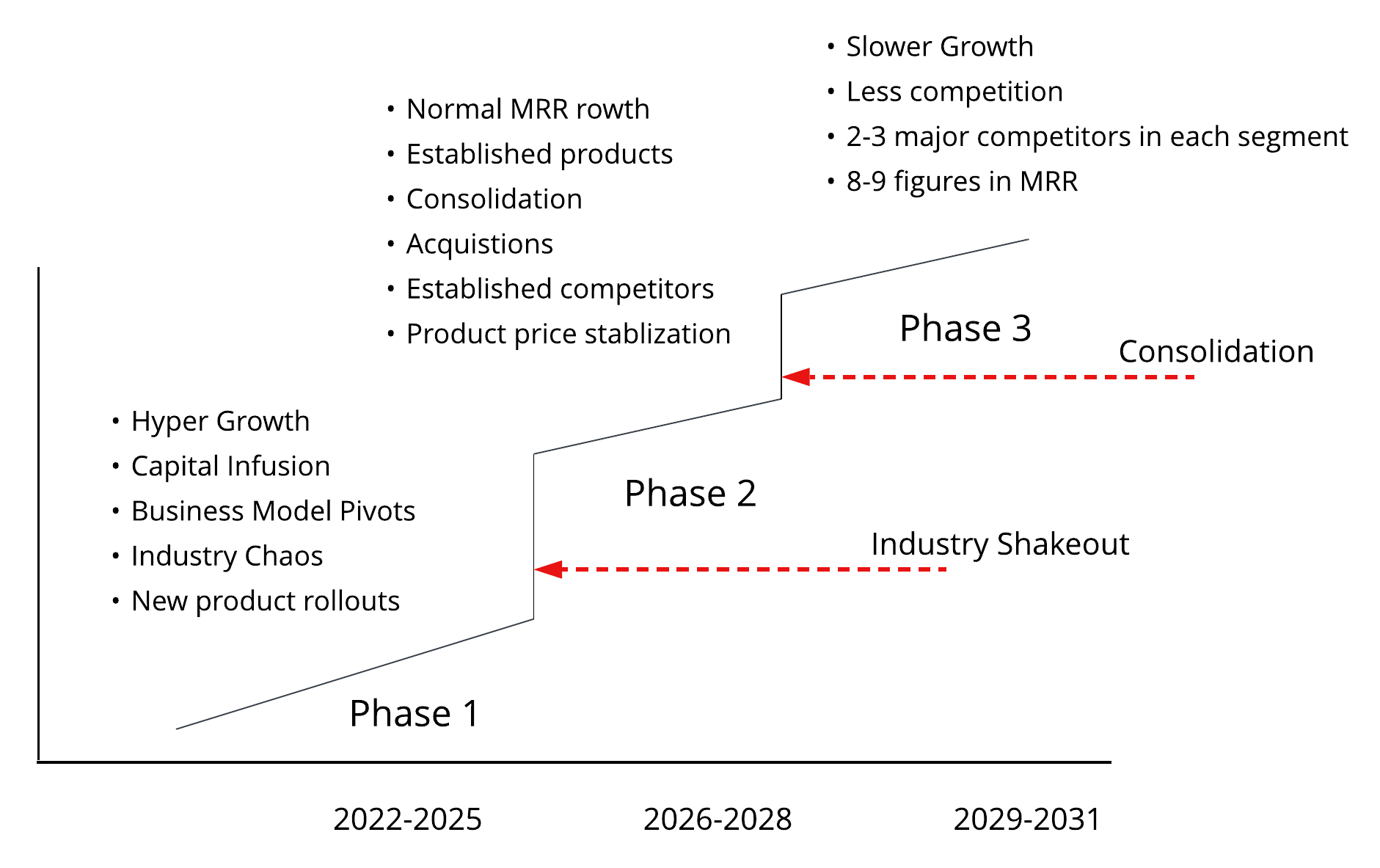

In the first phase of any emerging industry, the landscape is marked by hypergrowth, rapid product rollouts, chaos, and frequent pivots. Today’s AI infrastructure market reflects exactly that—hundreds of startups competing alongside a handful of giants.

Some of the most striking pivots have come from companies like CoreWeave. Originally a crypto mining outfit, CoreWeave shifted into GPU cloud infrastructure before evolving once again into a builder of AI factories for large clients. Lambda Labs appears to be following a similar trajectory. This move is strategic: constructing AI factories that cost billions of dollars creates a formidable barrier to entry for the many smaller players in the ecosystem.

By contrast, renting GPUs by the hour has become a commodity—something more than a hundred providers, including traditional web hosting companies, can offer. Startups in the inference segment, however, carve out stronger differentiation. Companies like Baseten and Together AI go beyond raw GPU access by layering sophisticated software stacks on top of the hardware, making their platforms more integrated, specialized, and defensible than standard GPUaaS offerings.

The pivot from GPUaaS to AI factories is unprecedented. It extends beyond what traditional data center companies like Digital Realty provide, since CoreWeave is not only delivering space and power but also assembling purpose-built GPU server infrastructure. To achieve this, CoreWeave partners with industrial developers such as Chirisa Technology Parks, pushing them further up the value chain and closer to being a critical enabler of the AI boom.

GPUaaS to AI Factories

AI Infrastructure Evolution

The AI infrastructure industry is still in its hyper-growth phase, fueled by massive capital infusions and rapidly evolving business models. But this stage won’t last forever. As the market matures, it will enter new phases in its lifecycle. A useful comparison is the CDN industry, which offers a baseline for thinking about how AI infrastructure might evolve.

Cloudflare launched in 2008, with Fastly following soon after, and it took roughly 15 years for the CDN market to shake out, culminating in recent consolidation. By contrast, the pace of AI infrastructure is far more accelerated; we may see similar consolidation and maturity within just seven years.

Industry lifecycles are usually punctuated by catalyst events that push the market from one phase to the next. In the CDN industry, Akamai’s acquisition of Prolexic shifted the focus toward security services, while the rise of edge compute forced providers to become more AWS-like. In AI infrastructure, the likely catalyst will be a recession—an economic event that forces out undercapitalized startups and weak business models, leaving stronger players to define the next phase of the industry.

AI Infra Evolution

Conclusion

The AI infrastructure ecosystem is undergoing rapid transformation, moving from the early days of commoditized GPUaaS toward differentiated models such as AI factories and inference platforms. As in other industries, business model pivots are not just common but necessary for survival. The parallels with the CDN industry provide a useful lens: early growth, a shakeout driven by external catalysts, and eventual consolidation around stronger players.

If history is any guide, today’s AI infrastructure landscape will look very different in just a few years. Many of the startups flooding the space will not survive, while those that adapt—by innovating beyond commodity services and building defensible business models—will shape the foundation of the next era of AI. The shakeout is coming, and the companies that pivot fastest and climb highest up the value chain will be the ones left standing.