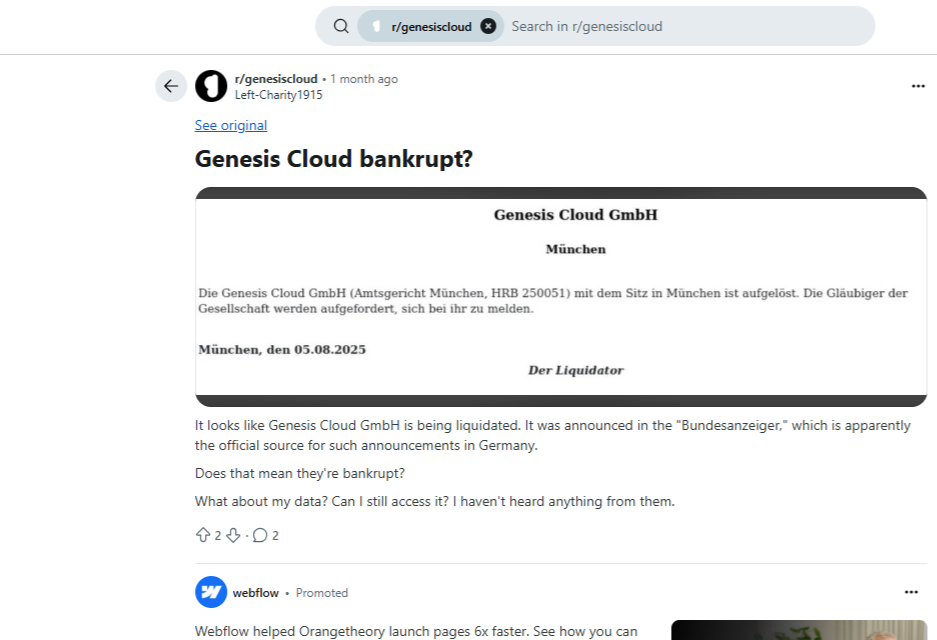

Genesis Cloud, a Munich-based pure-play GPU-as-a-Service (GPUaaS) provider, is reportedly in liquidation. As of now, public information is limited to a Reddit post and a mention on the company’s homepage, where it is listed as Genesis Cloud GmbH i.L. (“i.L.” denotes in liquidation in Germany).

While Genesis Cloud was a relatively small player, having raised $6.6M, it represents the pure-play GPUaaS segment, a category with dozens of startups attempting to carve out a niche in the AI infrastructure industry. Its apparent closure may signal broader challenges in this market.

Background

- Startup: Genesis Cloud

- Founded: 2018

- HQ: Munich, Germany

- # of Employees: 24 (LinkedIn)

- Funding: $6.6M (Crunchbase)

Timeline of Key Events

Based on historical blog posts (links omitted due to potential site shutdown), the following milestones can be reconstructed:

- May 26, 2021 – Nvidia RTX 3080 and 3090 GPUs made available for rental.

- April 5, 2022 – Prices dropped: RTX 3090 from $1.70/hr to $1.30/hr, RTX 3080 from $1.10/hr to $0.90/hr. A second Point of Presence (PoP) opened in Norway.

- August 19, 2022 – Nvidia GeForce RTX 3060 Ti deployed in the Norway data center.

- March 31, 2023 – Further price reductions: RTX 3080 to $0.30/hr, RTX 3090 to $0.70/hr.

- November 20, 2023 – Nvidia H100 GPU instance rolled out.

Observations and Red Flags

- Rapid Price Declines: In less than a year, RTX 3090 rental rates fell from $1.30/hr to $0.70/hr, and RTX 3080 rates dropped from $0.90/hr to $0.30/hr. Such sharp declines indicate intense price pressure in the GPUaaS market.

- Hardware Cost Discrepancy: H100 GPU instances, priced at $25k–$30k per card, contrast sharply with RTX 3090 units, which ranged from several hundred to a couple thousand dollars depending on model. This implies a steep increase in capital expenditures for next-generation hardware.

Possible Causes of Liquidation

The exact reasons behind Genesis Cloud’s liquidation remain speculative. However, the company’s trajectory mirrors that of other infrastructure-heavy startups, such as Subspace: aggressive capital expenditures, high operating costs, and product strategy challenges likely contributed.

For the broader GPUaaS ecosystem, Genesis Cloud’s exit underscores the difficulties of sustaining margins amid rapidly declining GPU rental prices and the need for continual investment in expensive, next-generation hardware.

Here are snapshots of the company website (www.genesiscloud.com). It might shut down after liquidation.