Edgio, Lumen (CDN), and StackPath are no more. One important segment of the CDN industry has nearly collapsed. The last domino standing is Fastly. If it exits the CDN market, the collapse will be complete, and a new competitive landscape will emerge in the enterprise segment. The mid-market segment was critical because it puts pricing pressure on the bigger CDNs.

- Enterprise: Akamai, Cloudflare, and CloudFront

- Midmarket:

StackPath,Edgio, andLumen, and Fastly (?) - Niche: Medianova, Cachefly, Mainstreaming, CDN77, Bunny.net, and others

If only two prominent pure-play CDNs remain in the enterprise segment and no mid-market competition, Akamai and Cloudflare will be in a position to raise content delivery prices, perhaps even significantly.

Regarding Fastly, will the market support three public CDNs and AWS CloudFront? Let’s review the facts in front of us.

Fastly Earnings

| Product | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

| Network SVC | $107.4M | $104.2M | $106M | – | – |

| Security | $26.2M | $25.4M | $24.6M | – | – |

| Total | $137.2M | $132.4M | $133.5M | $137.8M | $127.8M |

| GAAP Net Loss | -$38M | -$43.7M | -$43.4M | -$23.4M | -$54.3M |

Akamai Earnings

| Product | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

| Delivery | $319M | $329M | $352M | $389M | $379M |

| Security | $519M | $499M | $491M | $471M | $456M |

| Compute | $167M | $151M | $145M | $135M | $130M |

| Total | $1.0B | $980M | $987M | $995M | $965M |

| GAAP Net Income | $71M (inc. restructuring fee) | $148M | $167M | $185M | $176M |

As shown above, Fastly is in a difficult position since it derives much of its revenue from content delivery services (“Network Services”) which grow or decline in any given quarter. More importantly, they continue to lose money quarterly on a GAAP basis (Total Revenue-Total Expenses), although net income was $2.4M for Q3 2024.

To add salt to the wound, the overall market for delivery traffic continues to struggle in this economy as Akamai and Fastly indicated on their earnings call. Thus, will the market support three public CDNs and CloudFront? The odds are not in Fastly’s favor.

The good news for Fastly, it generates $100M per year in security revenue which many companies would kill for. In theory, Fastly could sell their CDN business to Akamai and partner with Akamai for delivery, while they focus on security. Or it could get acquired entirely by a hyperscaler, Akamai, or another big tech company.

What happens if Fastly gets acquired?

Market Impact

Even if the midmarket segment goes away, the CDN industry continues as is, generating $5B annually, whether there are three public CDNs or five. The market has been mature for many years. At the top of the food chain are Akamai, Cloudflare, and AWS CloudFront. Fortunately, each one has a differentiated business model that provides some immunity from CDN revenue swings and declines.

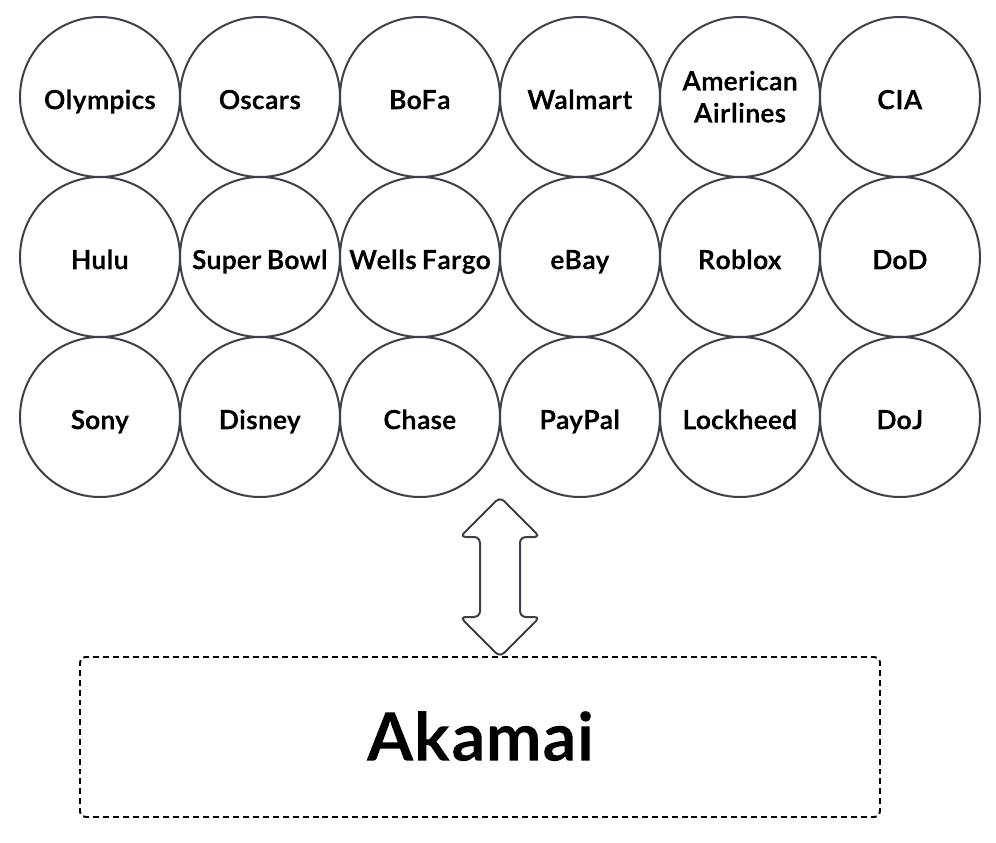

Without Fastly in the picture, Akamai becomes the undisputed global leader in CDN in several important categories including large-scale video streaming, media delivery, and content delivery. Think of Hulu, HBO, Disney, Oscars, eBay, Paypal, Sony, Lockheed, Bank of America, American Airlines, several government agencies, etc. In theory, Akamai would be able to increase CDN prices dramatically and likely get away with it in a world without Fastly. That doesn’t seem as bad as it sounds as delivery prices have bottomed out to sub-penny per GB/mo. for high volumes.

With Akamai at the top in several important categories, a Fastly exit might help them stabilize their delivery revenue, and increase it a bit.

Delivery revenue for Akamai is very important because although it’s declining, it provides sufficient cash flow for acquisitions, as Akamai’s CEO mentioned in the past on an earnings call.

In summary, the consolidation in the enterprise segment is good news for Akamai and Cloudflare.